Have you ever wondered how an APY calculator can benefit your investment decisions? Understanding the Annual Percentage Yield (APY) is crucial for maximizing your returns and making informed financial choices. This guide explores the benefits of calculating APY for your investments and how it can help you achieve your financial goals.

Understanding APY

APY, or Annual Percentage Yield, is a metric that measures the real rate of return on your investment, taking into account the effect of compounding interest. Unlike simple interest, which is calculated only on the initial amount, compound interest includes interest on the interest already earned. This makes APY a more accurate reflection of your potential earnings.

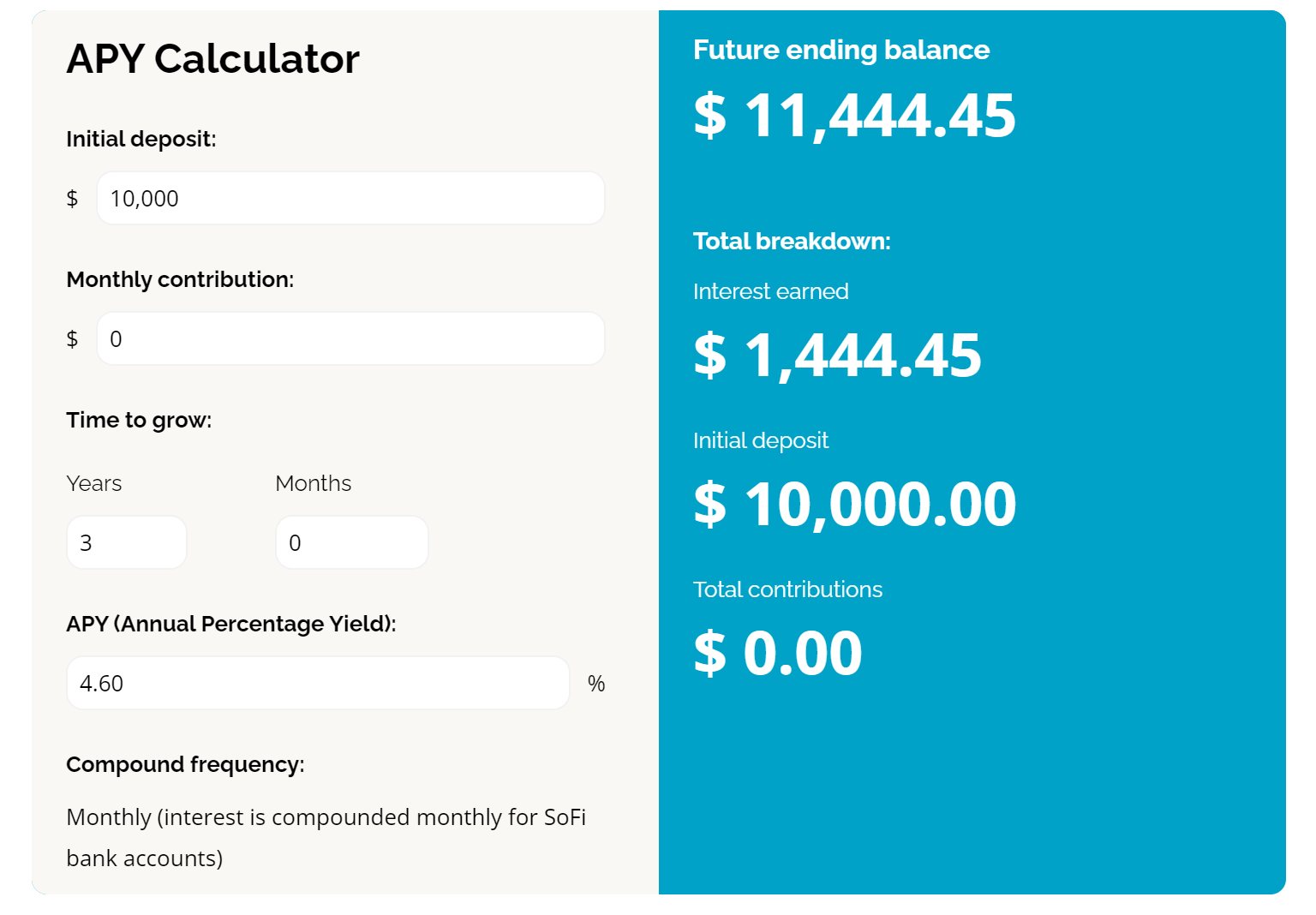

Using an APY calculator helps you understand the true growth potential of your investments. It clearly shows how much your money will grow over time, considering the compounding effect, which is often overlooked in simple interest calculations.

SoFi experts say, “An APY calculator, gives you important information to determine your account’s profitability.”

Comparing Investment Options

One of the main benefits of using an annual percentage yield calculator is the ability to compare different investment options. Different banks and financial institutions offer various interest rates and compounding periods, which makes it challenging to determine which option will yield the best return.

An annual percentage yield calculator allows you to easily compare the real returns on different investments by inputting the interest rates and compounding periods. This comparison helps you choose the investment that offers the highest APY, ensuring that your money works harder for you.

Planning for Long-Term Goals

Calculating APY is particularly useful for long-term financial planning. Whether you’re saving for retirement, a down payment on a house, or your child’s education, understanding the impact of compounding interest over time is essential.

An annual percentage yield calculator allows you to project the growth of your investments over various time frames. This projection helps you set realistic financial goals and develop a strategy. Knowing your investments will grow, you can decide how much to save and where to invest.

Maximizing Compound Interest

The power of compound interest is often underestimated. Small differences in interest rates can significantly impact the growth of your investments over time. An annual percentage yield calculator helps you see the compounding effect, highlighting the importance of choosing investments with higher APYs.

Regularly using an annual percentage yield calculator can optimize your investment strategy to maximize compound interest. This approach ensures that you make the most of your savings, leading to greater financial growth and stability in the long run.

Reducing Financial Risk

Understanding APY also helps reduce financial risk. Investments with higher APYs often come with different risk levels. By comparing the APY of various investment options, you can assess the potential return relative to the risk involved.

Using an annual percentage yield calculator allows you to balance risk and return effectively. This balance is crucial for maintaining a diversified investment portfolio that aligns with your risk tolerance and financial objectives. By choosing investments with competitive APYs and acceptable risk levels, you can protect your assets while aiming for growth.

An annual percentage yield calculator offers numerous benefits, from understanding the true return on your investments to comparing different options, planning for long-term goals, maximizing compound interest, and reducing financial risk. Incorporating this tool into your financial planning allows you to make more informed decisions and optimize your investment strategy. Whether you’re a seasoned investor or just starting, calculating APY is vital in achieving your financial goals and ensuring your money works as efficiently as possible.